According to Zillow, three numbers will shape the 2025 housing market: 2.4%, 4.16 million, and $358,761. Confused? You should be. These key figures from Zillow’s 2025 forecast send mixed signals that even the experts are scratching their heads.

In the video above and the narrative below, I explain how these figures will impact your housing market expectations and how you can use them to stay ahead of the curve. Let’s dive into what Zillow’s forecast means for you and your real estate decisions.

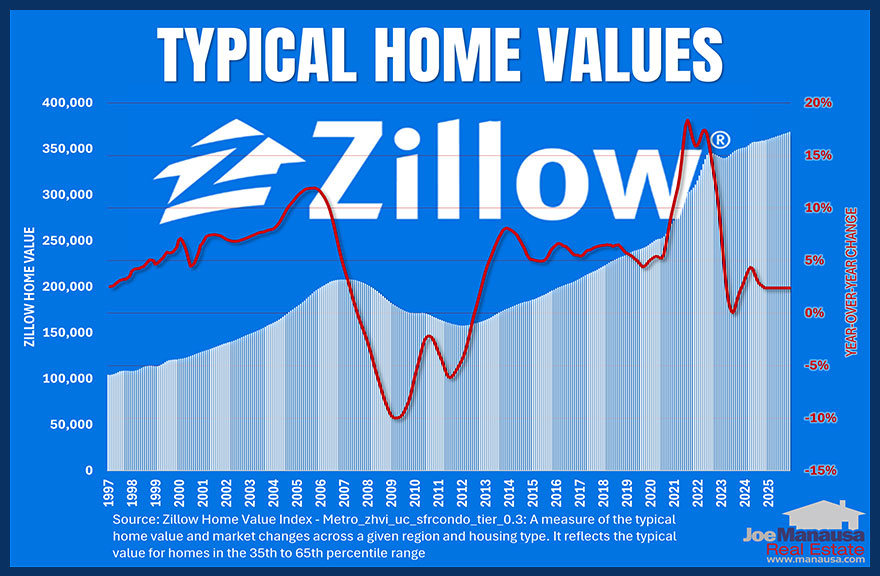

The Surprising Shift in Home Values

Zillow’s latest report on forecasted home values might surprise you.

They’re now predicting just 2.4% growth in home values over the next 12 months, a significant shift from their earlier optimism about 2025. This change isn’t random – it’s based on key economic indicators pointing to higher mortgage rates than previously expected.

Inventory is increasing, which is good news for buyers who’ve been struggling to find homes. But here’s the catch – it’s still well below pre-COVID levels, keeping upward pressure on prices. And since most new listings aren’t from builders, each one tends to bring a new buyer to the market too. So, when you hear other YouTube channels exclaim that inventory is rising, they aren’t telling you that when those homes sell, demand will rise and we’ll still be facing a super competitive market.

The market isn’t uniform across the country. In fact, 42 of the 50 largest metro areas are still seeing annual price gains. Cities like San Jose, New York, and Providence are leading with gains of 7.5%, 7%, and 6.7% respectively. But if we look at month-to-month changes, we see a different picture. In November, only San Jose saw a slight increase of 0.3%, while 47 areas actually experienced declines.

Despite these mixed signals, home values are still expected to climb in 2025, contrary to many expert predictions of a significant cooldown. It’s a testament to the housing market’s resilience in the face of economic challenges.

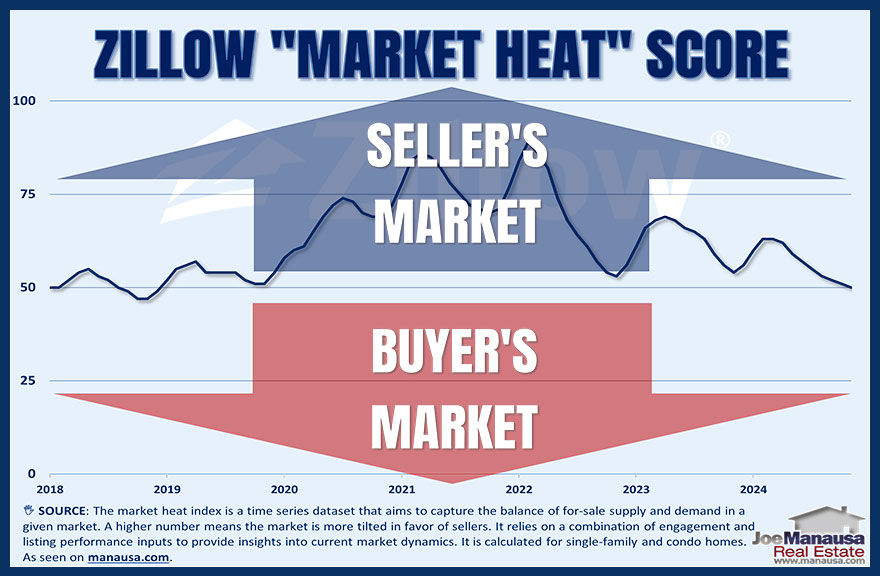

But there’s some relief for buyers. Zillow’s market heat index shows that competition for homes has cooled nationwide, and overall is close to balance.

The share of homes sold above list price dropped below 28% in October and continued to decline in November, hitting 27.8%. While still high, it suggests that the frenzied bidding wars of recent years might be easing up.

What does this mean for you? The market is complex and evolving. While prices are still rising overall, the pace and pattern vary widely by location. Understanding these trends is crucial whether you’re planning to buy or sell a home in the near future.

Keep Up With New Trends In Tallahassee!

Get The Tallahassee Real Estate Newsletter

Don't be the one that doesn't know what's going on when you sell a home or buy a home in Tallahassee.

Don't be the one that doesn't know what's going on when you sell a home or buy a home in Tallahassee.

Other buyers, sellers, lenders, and real estate agents have this critical information, and now you can too!

Get immediate access to our most recent newsletter.

Let more than 30 years of experience work for you with charts, graphs, and analysis of the Tallahassee housing market.

The Home Sales Puzzle

Zillow’s forecast for 2025 home sales is 4.16 million.

At first glance, it might seem like good news. Zillow is actually forecasting a 2.5% increase in existing home sales for 2025. However, this forecast has been revised downward from their previous predictions. So why the change?

Let’s break it down. Mortgage rates aren’t falling as fast as many had hoped. Zillow was expecting a significant drop, but it looks like we’re in for a more gradual decline. This slower rate reduction is putting a damper on buyer enthusiasm and keeping some potential homeowners on the sidelines.

New listings are still lagging behind pre-pandemic levels by 13.5%.

This significant shortage of homes hitting the market is creating a bottleneck in the sales process, limiting the number of transactions that can take place.

This situation creates a complex dynamic for buyers and sellers. The shortage of homes is keeping prices elevated, which benefits sellers. However, it’s making it harder for buyers to find affordable options, especially when combined with higher mortgage rates.

Zillow’s latest report shows that while it expects rates to fall in 2025, it’s going to be a much more modest decline than many were hoping for. This means only a small improvement in affordability, which could be the difference between being able to afford a home and having to continue renting for many potential buyers, especially first-time homeowners.

Since pre-pandemic times, the income needed to afford rent has increased by 33%. This jump is putting additional pressure on potential homebuyers to make the leap into ownership, even in a challenging market.

There are some signs that the market is beginning to balance out, albeit slowly.

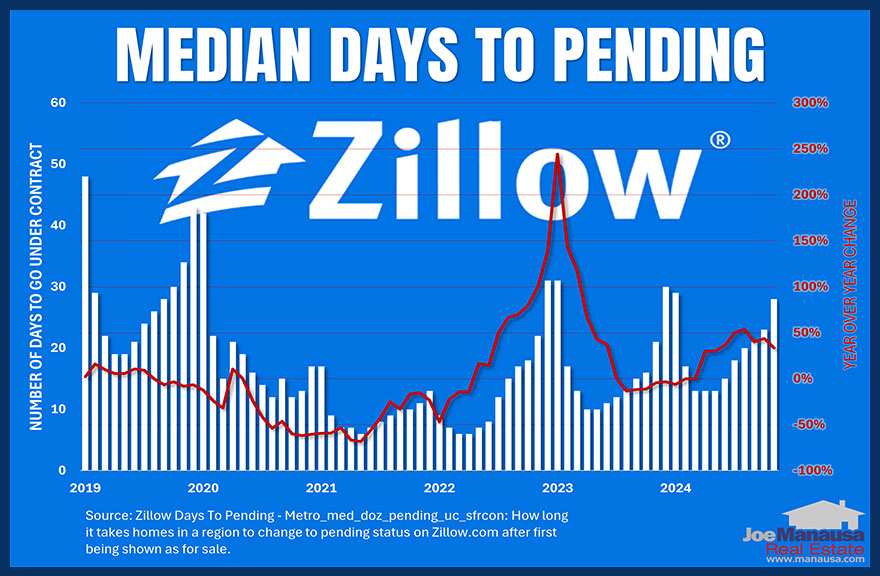

The median time from listing to pending sale has increased to 28 days, up from previous months. This slower sales pace could give buyers more time to make decisions and potentially negotiate better deals.

So what’s the bottom line here? Existing home sales are expected to increase in 2025, but not as much as Zillow initially expected. The lingering affordability challenges, driven by inventory shortages and higher-than-expected mortgage rates, are putting a cap on market growth.

This situation raises some critical questions about the future of mortgage rates. How low will they actually go? And what impact will this have on the market as a whole? These are the puzzles we need to solve to truly understand what’s in store for the housing market in 2025 and beyond.

Housing Crash or Boom? Here’s What’s Coming in 2025

BIGGEST Housing Market Myth EXPOSED by New Foreclosure Data

The Mortgage Rate Mirage

Zillow’s latest mortgage rate prediction for 2025 is challenging expectations about the housing market. Despite earlier predictions of falling rates, the reality is shaping up to be more nuanced. Zillow forecasts only a moderate decrease in mortgage rates, creating a ‘sticky’ rate environment that’s influencing market dynamics in unexpected ways.

This higher-than-anticipated rate situation is causing some potential buyers to reconsider their plans. Many are choosing to remain in the rental market longer, which is creating ripple effects throughout the housing sector. One notable change is the decreasing share of homes sold above list price.

While this figure has dropped, it remains high by historical standards at 27.8%. This indicates a cooling market compared to recent years, but we’re still far from a true buyer’s market.

The persistently high mortgage rates are extending affordability challenges for many potential homeowners. This is particularly impacting first-time buyers who don’t have equity from a previous property to leverage. However, the current market conditions are creating opportunities for prepared buyers. With fewer bidding wars and increased inventory, some buyers are finding themselves in stronger negotiating positions.

For example, buyers might now have more success with contingent offers or requests for seller concessions. There’s also potentially more room for price negotiations, especially on properties that have been on the market for a while. Some buyers are even finding success with lease-option agreements, allowing them to lock in a purchase price while renting initially.

The 2025 housing market is shaping up to be a complex landscape that rewards patience, preparation, and a solid understanding of local trends. It’s not the buyer’s paradise some hoped for, but it’s not without opportunities either. As we move forward, it’s clear that the interplay between mortgage rates and housing market dynamics is more intricate than ever, reminding us that in real estate, every trend has its nuances and every forecast has its caveats.

Fannie Mae Report: It's The TRUTH About The Housing Market

Real Estate Meltdown: Starter Homes at $1M in 233 Cities

Is the Housing Market Crashing? | Redfin April 2025 Update

Is This The CALM Before The CRASH? Volatility Rocks Housing

Warning Signs For Home Buyers And Sellers

The Rental Market Twist

I believe it is important for homeowners and buyers to stay abreast of the rental market as it often is an early indicator of home price changes.

Zillow’s latest rental market analysis reveals a paradoxical trend: record-high rental concessions alongside predictions of climbing rent prices. This seemingly contradictory situation is influencing both renters and potential homebuyers.

Despite talks of a cooling market, Zillow has revised its rent growth forecast upward.

Single-family rents are expected to grow by 4.1% in 2025, while multifamily rents are forecasted to increase by 2.8%. These significant rises in housing costs are occurring even as landlords offer more perks than ever before.

Zillow believes the reason behind this trend lies in the persistent challenges of the homebuying market. With high mortgage rates and stable home prices, many would-be homebuyers are priced out of ownership, turning to rentals as a long-term solution. This shift is reflected in Zillow’s Consumer Housing Trends Report, showing that renters are getting older and more likely to have children. Families are increasingly viewing renting as a viable long-term housing option. For our long-time viewers, you might remember a video I released a few years ago demonstrating my concern that we were heading towards being a renter nation. Zillow’s latest report seems to support this.

The rental market’s transformation is evident in the numbers. Since the start of the pandemic, rents have increased by 33.3%, highlighting the long-term upward trend in rental prices. This substantial increase underscores the challenges renters face in saving for homeownership.

For renters, this trend suggests potentially higher costs in the coming years. Those considering buying might find homeownership more appealing, despite current challenges. The decision depends on individual financial situations and long-term goals.

The rental and homebuying markets are more interconnected than ever. Understanding these dynamics is crucial for making informed housing decisions in 2025 and beyond. As we navigate these shifting trends, staying informed will be key to adapting to the changing landscape of housing options.

Buy Now Or Wait? The 91.6% Rule

Biased Results? The New York Times Rent Or Buy Calculator

Do's And Don'ts During The Home Loan Process

6 Real Estate Contract Terms You Should Not Overlook

7 Tips On Buying A Home With A Pool

How much house can you actually afford (By Income)?

What Does "Marry The House Date The Rate" Mean In Real Estate?

Why Fixer Uppers Are the New Gold | Home Renovation Guide

8 Tips For Buying An Affordable Florida Vacation Home

The 2025 Housing Market

Zillow’s outlook for the 2025 housing market has changed from its earlier expectations, but it believes there’s still potential for buyers and sellers who know how to navigate the changing conditions. Early 2025 could offer opportunities, with less competition and more room for negotiation in a market that’s becoming increasingly buyer-friendly.

As we look ahead, it’s crucial to stay informed about local trends and be ready to adjust your approach. Keep an eye on factors like interest rates, inventory levels, and price fluctuations in your area. For buyers, this might mean expanding your search to include up-and-coming neighborhoods or considering properties that need a little TLC. Sellers should focus on competitive pricing and making strategic improvements that boost their home’s appeal.

Remember, success in real estate often comes down to timing and strategy. Whether you’re buying or selling, stay patient, do your research, and don’t hesitate to seek advice from local real estate professionals who can provide insights specific to your market.

To further your insight into what you can expect in the new year, check out my new video revealing Redfin’s 10 Epic Predictions for a better 2025 housing market, it does include thoughts that Zillow did not consider.